No rationale for giving subsidies to Tesla

Concession given to import of Tesla cars would could hamper the efforts being made by other car companies operating in India

Once again the issue of reducing import duty for importing their cars is in discussion for American electric car company Tesla. Till now, a 60 per cent import duty has been imposed on any car whose price is less than $ 40,000 and a 100 per cent import duty is imposed on cars costing more than $ 40,000. This is done to protect the Indian automobile industry from unfair foreign competition.

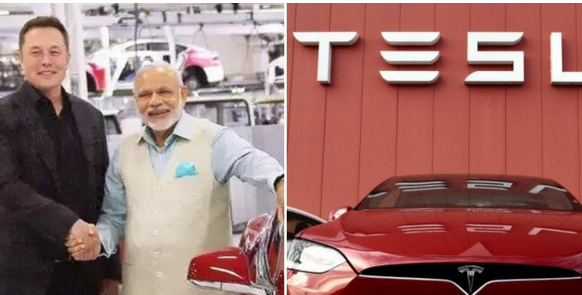

India's automobile industry has made remarkable progress in the last few decades . The share of the automobile sector in the total manufacturing output of the country is about 49 per cent and it constitutes 7.1 per cent of the total GDP. Most of the vehicles plying in the country are manufactured in India and very few vehicles are imported. Not only this, India's automobile exports were worth $21.2 billion. Tesla company has put up the condition of duty cut on the import of its cars to 18 per cent, for setting up a plant of car manufacturing in the country. The company says it is ready to invest $2 billion in the country, provided the import duty on its cars is reduced. Its request is under consideration . Today almost all the automobile companies in India have started producing electric and hybrid cars. In such a situation, customers already have options to buy electric cars. In India, nearly one lakh electric cars are sold monthly and the number is expected to rise rapidly.

Keeping in mind the growing market of Electric Vehicles (EVs) in the country, Tesla company has come up with a proposal to set up its plant in India, about which there is no opposition per-se . To encourage the production of electric cars in the country, the import duty on components has already been reduced significantly. Today, spare parts for electric cars are being imported at only 10 to 15 per cent import duty. These are much lower than the import duty on conventional automobile parts. Due to low import duty on electric car components, established automobile companies and startups in the country have started adding value to a large extent in the country. Given the incentives being given to electric cars by the Government of India, it seems that soon India will start meeting its requirement of electric vehicles. Till now, the key to the development of the automobile industry in the country has been the protection given to this industry by the government. Concession given to import Tesla cars would not be right, as it could hamper the efforts being made by the companies already operating in the country. But more importantly, Tesla company manufactures luxury cars. In 2019-20, only 40637 luxury cars were sold in the country, which was reduced to only 19700 in 2020-21 during the Covid-19 period. The reason for this is that only a very small section of the country can buy luxury cars more expensive than 16 to 17 lakh rupees i.e. $20000 US and even a smaller section can buy a car worth $40000 i.e. 32-33 lakh rupees. In such a situation, if Tesla company is given an exemption in import duty, then rich people who can buy expensive cars will naturally buy imported Tesla cars. This will affect the manufacturing of luxury electric cars in the country. Not only this, many other companies, including Volkswagen, who are also in the queue , will also demand lower import duty. We also have to understand that domestic companies are already putting a lot of effort into research and development in manufacturing electric cars. An Indian company 'Ola', with the help of investors, has made significant progress in manufacturing electric scooters in the country. Similar efforts can be made in cars, but the concession in import duty will hamper these efforts. We have to understand that Tesla's business model is such that it does not encourage domestic manufacturers of components, and only uses internal manufacturing technology. The expectation that the downstream value chain will develop with the arrival of Tesla company is not correct.